Opening Development Potential: Bagley Risk Management Approaches

Opening Development Potential: Bagley Risk Management Approaches

Blog Article

Exactly How Animals Risk Defense (LRP) Insurance Can Protect Your Animals Investment

Livestock Risk Protection (LRP) insurance coverage stands as a reputable guard versus the uncertain nature of the market, supplying a critical technique to guarding your properties. By diving right into the details of LRP insurance policy and its diverse advantages, animals manufacturers can fortify their investments with a layer of safety and security that goes beyond market variations.

Comprehending Livestock Risk Defense (LRP) Insurance Coverage

Understanding Animals Danger Security (LRP) Insurance coverage is important for animals producers looking to alleviate financial threats connected with cost variations. LRP is a federally subsidized insurance coverage item created to safeguard manufacturers against a decline in market rates. By supplying coverage for market value declines, LRP assists producers secure a flooring price for their animals, ensuring a minimal degree of profits regardless of market variations.

One key facet of LRP is its flexibility, enabling manufacturers to personalize protection degrees and policy lengths to match their specific demands. Producers can select the variety of head, weight range, protection rate, and insurance coverage period that line up with their production objectives and risk tolerance. Recognizing these personalized alternatives is critical for producers to successfully handle their price danger direct exposure.

In Addition, LRP is available for various livestock kinds, consisting of cattle, swine, and lamb, making it a versatile danger administration device for livestock producers throughout various sectors. Bagley Risk Management. By familiarizing themselves with the ins and outs of LRP, manufacturers can make enlightened decisions to protect their investments and make sure financial security when faced with market uncertainties

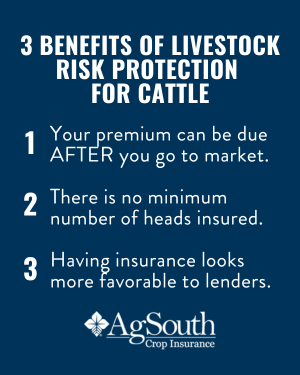

Benefits of LRP Insurance Coverage for Livestock Producers

Livestock producers leveraging Livestock Danger Security (LRP) Insurance coverage acquire a calculated benefit in securing their financial investments from rate volatility and safeguarding a steady monetary ground amidst market uncertainties. One key advantage of LRP Insurance policy is rate protection. By setting a floor on the rate of their animals, manufacturers can mitigate the risk of significant financial losses in the occasion of market slumps. This enables them to prepare their budget plans better and make notified decisions concerning their operations without the continuous worry of price variations.

Additionally, LRP Insurance offers manufacturers with tranquility of mind. Recognizing that their investments are protected versus unexpected market adjustments allows producers to focus on various other facets of their organization, such as improving animal health and wellness and well-being or maximizing manufacturing processes. This assurance can cause raised productivity and success over time, as manufacturers can run with even more self-confidence and stability. In general, the benefits of LRP Insurance coverage for livestock manufacturers are considerable, using a useful device for taking care of threat and guaranteeing monetary safety in an unforeseeable market atmosphere.

How LRP Insurance Mitigates Market Dangers

Minimizing market dangers, Livestock Threat Security (LRP) Insurance provides animals producers with a dependable guard against rate volatility and monetary uncertainties. By supplying security versus unexpected rate decreases, LRP Insurance policy assists producers protect their financial investments and preserve economic stability when faced with market fluctuations. This sort of insurance permits livestock producers to secure a price for their pets at the beginning of the plan duration, guaranteeing a minimal price level no matter market changes.

Steps to Protect Your Livestock Investment With LRP

In the realm of agricultural risk management, executing Livestock Risk Protection (LRP) Insurance involves a strategic process to secure investments against market variations and unpredictabilities. To protect your animals financial investment efficiently with LRP, the initial step is to evaluate the details dangers your procedure faces, such as cost volatility or unforeseen weather events. Recognizing these dangers enables you to identify the insurance coverage degree needed to protect your financial investment adequately. Next, it is vital to research study and select a trusted insurance service provider that offers LRP plans tailored to your animals and service needs. Very carefully review the plan terms, conditions, and coverage restrictions to ensure they straighten with your risk monitoring goals when you have actually selected a service provider. In addition, frequently monitoring market patterns and readjusting your coverage as needed can assist enhance your security versus prospective losses. By adhering to these actions carefully, you can boost the safety and security of your livestock financial investment and navigate market unpredictabilities with confidence.

Long-Term Financial Protection With LRP Insurance Policy

Making sure sustaining economic security with the use of Livestock Risk Protection (LRP) Insurance is a prudent long-lasting technique for agricultural producers. why not look here By including LRP Insurance policy right into their threat administration plans, farmers can safeguard their animals financial investments against unexpected market fluctuations and adverse occasions that might endanger their financial health gradually.

One secret benefit of LRP Insurance policy for long-lasting financial security is the tranquility of mind it provides. With a reputable insurance plan in position, farmers can reduce the economic dangers associated with unpredictable market conditions and unexpected losses as a result of elements such as disease break outs or natural catastrophes - Bagley Risk Management. This stability allows producers to concentrate on the everyday operations of their animals business without consistent fret about possible financial obstacles

Furthermore, LRP Insurance policy offers an organized strategy to managing risk over the long-term. By setting certain coverage levels and picking ideal endorsement periods, farmers can customize their insurance plans to align with their monetary goals and risk resistance, making sure a safe and sustainable future for their livestock operations. Finally, spending in LRP Insurance is a positive method for farming producers to attain enduring economic security and secure their resources.

Conclusion

To conclude, Animals Threat Protection (LRP) Insurance is an important tool for livestock manufacturers to mitigate market risks and secure their investments. By comprehending the benefits of LRP insurance coverage and taking steps to apply it, producers can achieve long-term financial security for their operations. LRP insurance provides a security internet against cost changes and guarantees a level of stability in an uncertain market atmosphere. It is a smart option for protecting livestock financial investments.

Report this page